Low battery

Battery level is below 20%. Connect charger soon.

Taux de Change Euro Dollar: The Shocking Fluctuation Investors Are Watching Closely

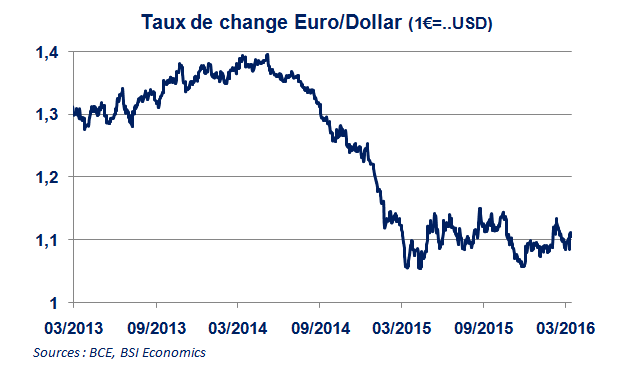

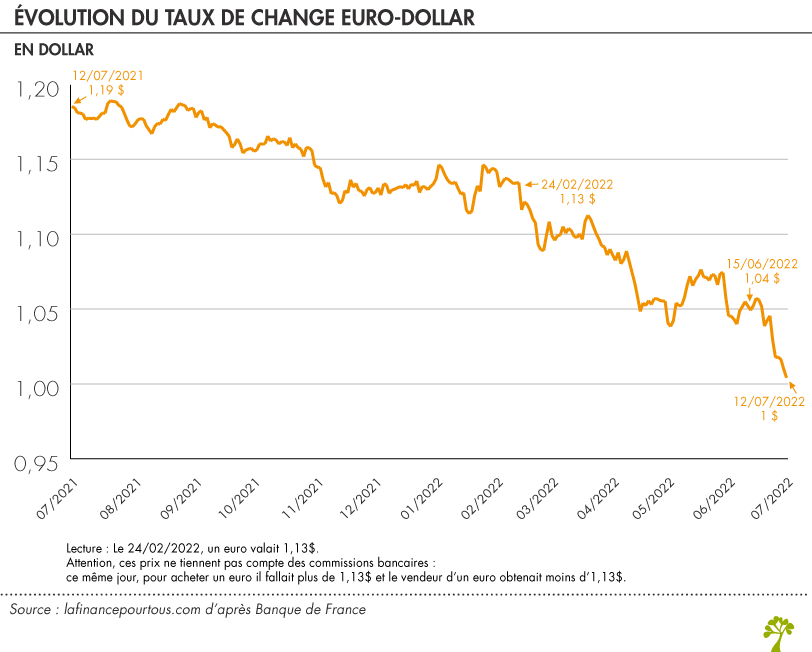

The Euro-Dollar exchange rate (EUR/USD) has experienced significant volatility recently, leaving investors on edge and closely monitoring every fluctuation. This unpredictable movement stems from a confluence of global economic factors, making it crucial for businesses and individuals alike to understand the underlying forces at play. This article delves into the current state of the EUR/USD exchange rate, analyzing the key drivers behind its shocking fluctuations and exploring their potential implications.

Understanding the EUR/USD Exchange Rate

The EUR/USD exchange rate represents the value of one Euro in terms of US Dollars. A high EUR/USD rate signifies a strong Euro relative to the Dollar, meaning one Euro can buy more US Dollars. Conversely, a low rate indicates a weaker Euro. This seemingly simple relationship has profound consequences for international trade, investment, and tourism.

Key Factors Driving EUR/USD Volatility

Several interconnected factors contribute to the recent dramatic shifts in the EUR/USD exchange rate:

Inflation and Interest Rates: The divergence in inflation rates between the Eurozone and the US is a major driver. Higher inflation in one region typically leads to higher interest rates from its central bank (the European Central Bank or the Federal Reserve). Higher interest rates attract investment, strengthening the currency. The current contrasting monetary policies of the ECB and the Fed are significantly impacting the EUR/USD.

Geopolitical Uncertainty: The ongoing war in Ukraine, energy crises, and global political instability all contribute to uncertainty in the markets. This uncertainty often leads to investors seeking safe havens, impacting currency values.

Economic Growth Differentials: Differences in economic growth between the Eurozone and the US also influence the exchange rate. Stronger economic growth typically attracts investment, boosting the currency’s value.

Market Sentiment: Investor confidence and speculation play a significant role. Negative news or pessimistic forecasts can trigger sell-offs, leading to sharp depreciations.

The Impact of Fluctuations on Investors

The fluctuating EUR/USD exchange rate has significant implications for various stakeholders:

Businesses: Importers and exporters are particularly vulnerable. Fluctuations can impact profitability and pricing strategies. Hedging strategies become crucial to mitigate risk.

Investors: Currency fluctuations impact the value of international investments. Diversification and careful risk management are essential.

Travelers: The exchange rate directly affects the cost of travel to and from the Eurozone and the US.

Predicting Future Movements: A Difficult Task

Predicting the future direction of the EUR/USD exchange rate is notoriously difficult. While analyzing the factors mentioned above provides valuable insights, unforeseen events can dramatically alter the course. Experts offer diverse opinions, highlighting the complexity of the situation.

Conclusion

The recent volatility in the EUR/USD exchange rate underscores the interconnectedness of global economies and the impact of various factors on currency values. While predicting future movements remains challenging, understanding the key drivers – inflation, interest rates, geopolitical events, and market sentiment – is crucial for investors, businesses, and individuals navigating this dynamic landscape. Staying informed and adapting strategies based on market conditions is paramount.

Frequently Asked Questions (FAQs)

Q: How can I protect myself from EUR/USD fluctuations? A: Consider hedging strategies like forward contracts or options to mitigate risk. Diversify your investments across different currencies.

Q: What is the best time to exchange Euros for Dollars? A: There’s no single “best” time. The ideal time depends on your individual needs and risk tolerance. Monitoring market trends and seeking professional advice can help.

Q: Where can I find reliable EUR/USD exchange rate information? A: Reputable financial news websites and currency converters offer real-time exchange rate data.

Q: What role does the European Central Bank (ECB) play in the EUR/USD rate? A: The ECB’s monetary policy decisions, particularly regarding interest rates, significantly influence the Euro’s value against the Dollar.

Q: Are there any resources to help me understand currency trading? A: Many online resources, including educational websites and books, can help you learn about currency trading. However, remember that currency trading involves risk.